Describe your Product Product Information Select Category What is the Total Value of the Order. Ad FedEx Offers Reliable International Shipping Options Around the Globe.

Landed Cost Template Import Export Shipping Excel Templates Morning Quotes For Friends Price Calculator

The Malaysia VAT Calculator is designed to allow free online calculations for goods services and products which are subject to VAT Value Added Tax in Malaysia.

. GST Registered Yes No. Duties and Taxes Calculator. Prepare Your Shipment Today.

Import Calculator Tutorial Video JPY. The calculator allows quick VAT calculations and more detailed VAT calculations with multiple items productservice descriptions with a running total so you can see the VAT due on. Required to calculate Import Duties Taxes What is the Shipping Cost.

B SOP Pelaksanaan Penguatkuasaan Pengimportan Mainan Kanak-Kanak. F Syarat dan Prosedur Pengimportan. Live animals-primates including ape monkey lemur galago potto and others.

The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities. Some goods are not subject to duty eg. You only need to upgrade if you want more than 5 calculations per day.

For the purpose of this calculation dutiable goods are given a classification code that is known as the Harmonized System code. Step 2 6. The calculation of duties depends on the assessable value of a dutiable shipment.

16 of Customs Value Import Duty Excise Duty IDF. Select the country of import from the drop-down list. Our prestige car duty calculator calculates the car import duty for prestige cars when imported to Kenya.

172022-Customs ADD Seeks to extend the Anti-Dumping Duty ADD on imports of Styrene Butadiene Rubber originating in or exported from European Union Korea RP and Thailand imposed vide Notification No. RM Exchange rates are updated every Sunday following CIMB rates Full Breakdown. This value includes the price paid for goods postage packaging and.

Direct import concept solution D concept car import tax malaysia car import agent Malaysia car import rules and regulations car import duty import car from australia to Malaysia malaysia car import tax calculator how to import a car shipping car to malaysia recond car AP car car from japan car from uk car from australia vehicle import duty importing a vehicle can i import a car. 2 of the CIF value. ITR Income Less than 2 Lacs 2 Lacs to 5 lacs More than 5 Lacs.

Soap organic surface-active agents washing preparations lubricating preparations artificial waxes prepared waxes polishing or scouring preparations candles and similar articles modelling pastes dental waxes and dental preparations with a basis of plaster. Its easy to estimate duties on this import duty calculator. COST INSURANCE FREIGHT FOB.

432017-Customs ADD dated 30th August 2017 till 31st October 2022. Laptops electric guitars and other electronic products. I agree to be contacted by Connect2India and its partner representatives for more information about this product.

Join as Partner Agent. Egg in the shells. PERFUMERY COSMETIC OR TOILET PREPARATIONS.

Some duties are also calculated based on their weight or volume. Every country is different and to ship to Malaysia. This import duty calculator only applies to imports into the US but it will soon be extended to include the UK and other EU European Union countries.

Additional costs that might not come up on your duty calculations. 5 Free Calculations Per Day At Simply Duty you get to use our duty calculator free of charge every day. Importing to which country.

D Panduan Pengimportan Semula Bagi Barangan Tempatan Yang Dikilang. Sales Tax GST Threshold on goods. Dont have an account.

Please check this box. VAT ST CIF Duty other taxes No duty if CIF value is less than or equal to MY 500 with the exception of alcohol wine and tobacco products from USA. G Atiga National Guideline 8 JAN 2015 13 MITI 1512015.

Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia and Herzegowina Botswana Bouvet. Use this calculator to estimate import duties and taxes for hundreds of countries worldwide. Dutiable shipments are subject to a customs duty which is a tariff or tax imposed on goods when transported across international borders.

This duty calculator is using the 2019 Current Retail Selling Price CRSP in line with the KRA directive issued in Aug 2020. Turnover in latest FY Less than 20 Lacs 20 Lacs to 50 lacs 50 Lacs to 1 CR More than 1 CR. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods.

How To Use Our Free US Import Duty Calculator. Malaysia uses the CIF valuation method Cost Insurance and Freight which means that the import duty and taxes payable are calculated from the total shipping value of the item including the cost of freight and insurance during shipping not just the product itself. 20 of Customs Value Import Duty VAT.

The duty and tax calculation for your shipment is as follows. Exporting from which country. For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that.

Duty Calculator Import Duty Tax Calculations Use this quick tool to calculate import duty taxes for hundreds of destinations worldwide. When shipping a package internationally from United States your shipment may be subject to a custom duty and import tax. Stamp Duty on MOT Stamp Duty Calculator Malaysia Calculate Stamp Duty on Memorandum of Transfer MOT This calculator calculates the estimated or approximate fees needed for Stamp duty on Memorandum of Transfer MOT.

Up to 2 cash back Duties Taxes Calculator to Malaysia. 35 of the CIF value or Ksh 5000 whichever is higher is payable. Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574.

Malaysia Import Duty Calculator. E Prosedur ImportEksport Barangan Melalui ATA Carnet. 11 rows Notification No.

Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry. Estimate your tax and duties when shipping from United States to Malaysia based on your shipment weight value and product type. Trust FedEx for Fast Shipping Solutions Internationally.

Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable. Register an account. By providing our team of brokers with several pieces of key information we can determine the rates due and assist you in clearing the products.

What is the HS Code of your Product. ESSENTIAL OILS AND RESINOIDS. We have tailored the KRA 2019 CRSP to focus on the prestige cars most suited to our clients.

Goodadas USA customs import and export duty calculator will help you identify the export tariff rates you will pay for the USA. Malaysia Import Duty Calculator Please complete information below Exporting from which country. Welcome back username Log Out.

Packing List Document Template For Import Export Packing List Packing List Template Purchase Order Template

Exporters Should Be Aware Of What Goods Are Most Exported From India In Order To Plan Their Business On Profitable Lines It Is Indian Carpet Iron Lamp Export

Delivered Duty Paid Ddp A Delivery Agreement Whereby The Seller Assumes All Of The Responsibility Risk And Costs Associate No Response Inco Terms Solutions

Example Of A Completed Sadc Certificate Certificate Of Pertaining To Certificate Of Origin For A Vehi Certificate Of Origin Bill Of Sale Template The Originals

List Of Shipping Documents That Are Required For The Import Export Process Incodocs Import Exports Database Business Busi Trading Export Marketing Tips

Document Creation Designed To Give You Back Time Incodocs Import Exports Database Business Busin Make Money Today Export Business Office Administration

Anti Dumping Duty Likely On Black Toner In Powder Form From China Others Photo Printer Printer Mobile Print

Commercial Invoice Template Download For Export Invoice Template Invoicing Invoice Management

How To Calculate Freight Cost Per Unit In Excel Excel The Unit Harmonized System

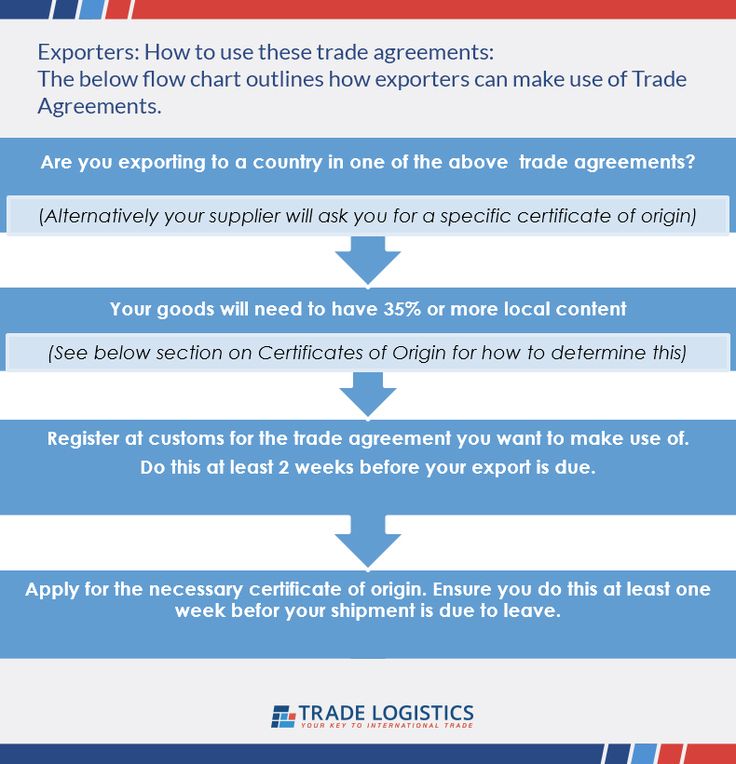

These Are General Considerations For Exporters To Make Use Of Trade Agreements Certificate Of Origin Flow Chart Trading

Pin By Trade Logistics On Import Export Basics Inspirational Quotes Quotes Wisdom

Pin On Create Sales Shipping Documents For Global Trade

Landed Cost Calculator For Imports Excel Templates Import Business Imports

Verified Gross Mass Vgm For Solas Explained Document Templates Declaration Words

A Graphic Representation Of The Incoterms 2010 Rules Courtesy Of S Llp

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets